The third relief package

The third relief package will reduce the burden on citizens by 65 billion euros. Following the coalition meeting, Federal Chancellor Scholz explained that the aim was to steer the country through this period effectively by providing short-term aid, making structural changes to curb the rise in energy prices, and imposing levies on windfall profits in the electricity market. The planned measures at a glance.

9 min reading time

The purpose of the measures, said Federal Chancellor Scholz of the resolutions adopted by the coalition committee, was to "get us through these difficult times together".

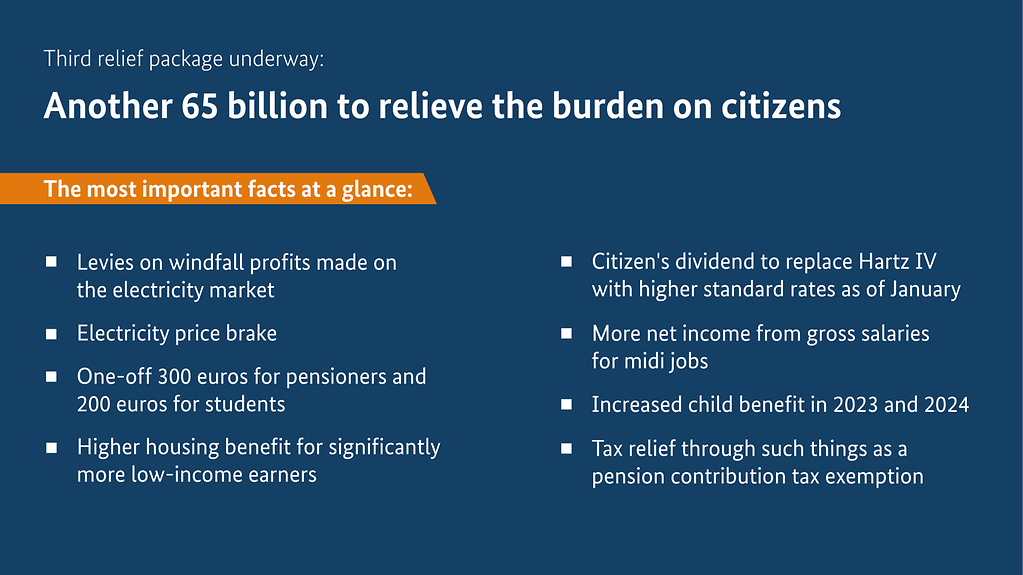

This graphic shows:

Heading: Third relief package underway:

Another 65 billion to relieve the burden on citizens

Bullet points:

- Levies on windfall profits made on the electricity market

- Electricity price brake

- One-off 300 euros for pensioners and 200 euros for students

- Higher housing benefit for significantly more low-income earners

- Citizen's dividend to replace Hartz IV with higher standard rates as of January

- More net income from gross salaries for midi jobs

- Increased child benefit in 2023 and 2024

- Tax relief through such things as a pension contribution tax exemption

Photo: Federal Government

As Federal Chancellor Olaf Scholz emphasised at the press conference on the results of the coalition meeting on Sunday, "The scope of the third relief package that we have now put together is greater than the first two combined". In total, the three relief packages amount to a volume of 95 billion euros. "We are mobilising a huge amount of funding,” said Scholz, “which is necessary and is intended to help citizens survive this situation together with us."

"It took some time," said Federal Minister of Finance, Christian Lindner about the planned package, "but I think the result is convincing.” “The third relief package represents a significant response to the crisis,” as Federal Minister for Economic Affairs, Robert Habeck explained, “and is based on a crucial principle, namely that the relief will be squarely directed at lower income earners.”

The details of the resolutions adopted are as follows:

The purpose of an electricity price brake is to provide tangible relief for citizens and small to medium-sized enterprises with utility tariffs. They are to benefit from a more cost-effective basic supply. People will still have an incentive to save energy. The electricity price brake is intended to help bring down electricity prices overall as well as to curb the increase in fees within the German power grid. Grid fees are an element of the price of electricity and are therefore borne by electricity consumers.

Levies will be imposed on at least some of the electricity producers' windfall profits in order to finance the electricity price brake. For example, energy companies that produce renewable, coal-fired or nuclear power at consistently low production costs are currently making very high windfall profits on the European electricity market, while the whole of Europe is suffering greatly from the sharp rise in electricity prices.

This is why the Federal Government is working hard in the European Union to ensure that such windfall profits no longer accrue or can be siphoned off. The EU energy ministers will be meeting for a special session on 9 September to discuss the siphoning off of windfall profits and the planned electricity price brake.

To avoid placing any additional energy cost burden on citizens and businesses, the CO2 tax increase, which was scheduled for the beginning of 2023, is to be postponed by one year. Under normal circumstances, the CO2 tax on fossil fuels such as petrol, diesel, heating oil, and natural gas, would have risen by five euros per tonne as of 1 January 2023.

Crisis-proof energy supply

The situation on the energy markets will ease in the medium and long term, as and when more secure alternatives to Russian gas become available. Ever since taking office in early December 2021, the Federal Government has been working on this. The gas storage facilities are already more than 85 percent full a month earlier than usual and the first liquefied natural gas terminals will be operational at the beginning of next year.

It is still important to reduce our energy consumption. This will help us as a country to get through this difficult time together, and limiting price increases will benefit everybody.

To provide targeted support for families, child benefit will be increased by 18 euros per month for the first and second child as early as 1 January 2023, and this will apply throughout 2023 and 2024. This translates into an annual increase of 432 euros for a family with two children for the next two years. This is particularly important for low-income families in view of the rising cost of living.

Low-income families will also benefit from a further increase in the child supplement, which has already been increased to 229 euros per month per child as of 1 July 2022 and will be increased again to 250 euros per month on 1 January 2023 in order to alleviate the additional burden on these families due to inflation. This benefit will remain available until the introduction of the basic child allowance.

Both students and vocational students are also being affected by rising energy costs. Following the heating allowance for BAföG recipients, all university students and those attending vocational college will now receive a one-off payment of 200 euros. The Federal Government will bear the associated costs and will consult with the federal states on how best to make the respective disbursements in a quick and non-bureaucratic manner where they are needed.

The largest housing benefit reform in Germany's history is scheduled to take effect on 1 January 2023, the aim being to ensure that significantly more low-income earners receive a higher housing allowance going forward. The number of people entitled to housing benefit is to be increased to two million, whereby the the benefit will include a permanent climate and heating cost component.

Housing benefit recipients will receive a “second one-off” heating allowance for the heating period from September to December 2022 with single person households receiving 415 euros, two person households 540 euros, and an additional 100 euros being made available for each additional person.

Pensioners will receive a one-off energy price allowance of 300 euros through the pension insurance scheme on 1 December, whereby the flat rate is more effective in the case of a low pension because of the associated tax liability.

Easing the burden of social insurance contributions (health, unemployment, and pension insurance) is particularly helpful for workers on low monthly incomes. Legislation is already in place to raise the maximum limit for employment in the transitional sector (midi-job) from 1,300 euros to 1,600 euros as of 1 October 2022, and this ceiling will now be increased to 2,000 euros per month as of 1 January 2023, which will reduce the burden on workers in this wage sector by about 1.3 billion euros per year, as they will pay significantly lower contributions for their social insurance.

The special regulations for short-time allowance will be extended beyond 30 September 2022, which will create security for companies and employees.

Unemployment benefit II and income support will be replaced by the modern citizen's dividend on 1 January 2023, whereby the annual increase in the citizen's dividend will be adjusted to cater for the expected needs-related inflation in the year of the adjustment. This means that inflation will be factored in better and faster in the future. This will start on 1 January 2023 when the citizen's dividend is launched, and will result in an incremental increase up to around 500 euros.

The tariff benchmarks in the income tax tariff will be adjusted, which will benefit around 48 million taxpaying citizens from employees, pensioners, and the self-employed to entrepreneurs as of 1 January 2023. These values will be adjusted in autumn when the progression and minimum subsistence level report is available.

The temporary 9-euro ticket available during the June to August period was a great success, which is why a nationwide local transport ticket is to be introduced. The Federal and State Transport Ministers are working on a joint concept for the introduction of a nationwide, digitally bookable season ticket as soon as possible, the goal being to sell the ticket for about 49 to 69 euros per month.

The reduction of VAT on food in the catering sector to seven per cent is to be extended with a view to relieving the burden on the catering sector and preventing any further fuelling of inflation.

The Federal Government will start to implement the internationally agreed global minimum taxation rate at the national level immediately, which will result in billions of euros in additional revenues over the long term.

Abolition of so-called double taxation (pension): Taxpayers will be able to fully deduct their pension contributions as early as 1 January 2023, two years earlier than originally planned. Pensions will be taxed in the payout phase in old age in the future.

VAT on gas reduced to seven percent: The VAT rate for gas consumption will be reduced to seven per cent rather than the normal rate of 19 percent for a limited period of time until the end of March 2024. This measure is expected to have an immediate anti-inflationary effect when the cut comes into effect on 1 October 2022.

Extension and improvement of the work-from-home allowance: The work-from-home allowance, which has already been extended until the end of 2022, will be extended and improved, enabling an income tax deduction of 5 euros per work-from-home day up to a maximum of 600 euros per year. Families living in smaller apartments lacking a separate study will also receive relief.

An aid programme will be introduced to provide even greater support for particularly energy-intensive companies which are unable to pass on increases in their energy costs. The existing measures will also be extended until the end of the year and their scope will also be expanded.

Companies experiencing difficulties due to high energy costs will also be able to benefit from the KfW programme, which includes credit assistance of one hundred billion euros.

The aim is to continue to help companies to invest in making their energy supply systems more efficient and converting them. An extension of the so-called peak compensation, i.e. an energy and electricity tax concession, is also planned for energy-intensive companies.

The electricity price brake is also to apply to small and medium-sized enterprises with utility tariffs.

Employees’ allowance for business-related expenses increase: The employees’ allowance for business-related expenses on income tax has been raised by 200 euros to 1,200 euros. Those in employment can therefore claim for work-related costs up to a value of 1,200 euros without having to submit supporting documents.

Long-distance commuter allowance increase: The commuters’ allowance for long-distance commuters (as of the 21st kilometre) has been increased from 35 to 38 cents for a limited period until 2026. Tax relief for those on low incomes will be delivered through the mobility premium.

All resolutions adopted by the Coalition Committee will be presented to the Cabinet before coming into force and will then pass through the Bundestag and the Bundesrat.