Economic stimulus package

A cut in value added tax, a one-off per-child payment, assistance for companies – the German government has initiated numerous tax breaks. They are to help the German economy recover swiftly from the crisis and equip the country for the future. Here is a round-up of the most important points.

2 min reading time

The Cabinet has adopted an economic stimulus package to revitalise the economy

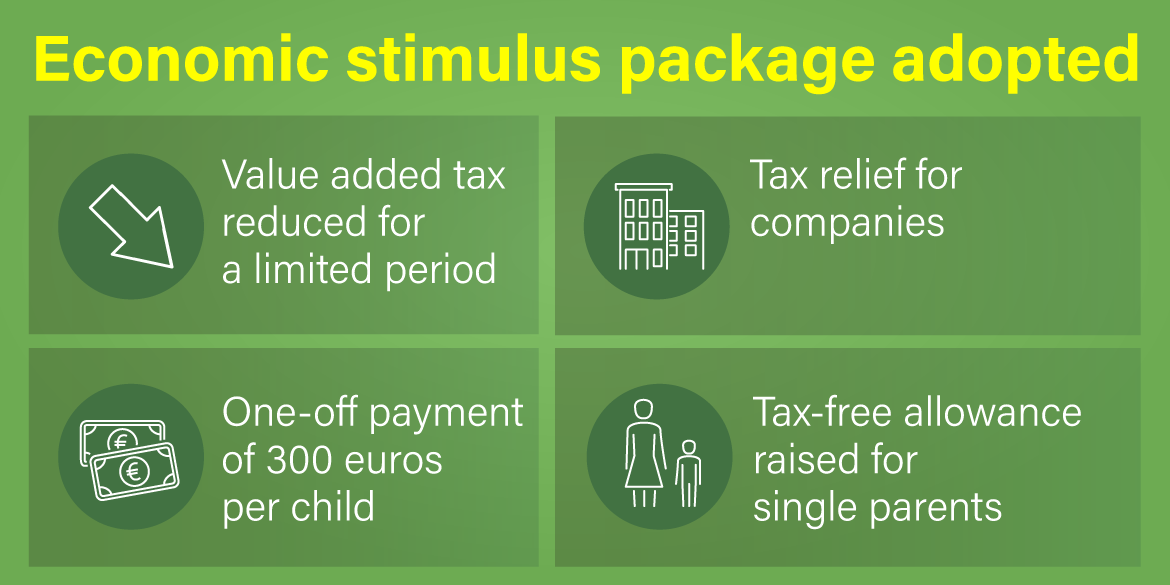

Economic stimulus package adopted

- Value added tax reduced for a limited period

- Tax relief for companies

- One-off payment of 300 euros per child

- Tax-free allowance raised for single parents

Photo: Bundesregierung

The economic repercussions of the coronavirus pandemic are extremely challenging for individuals and businesses. It is important that the economy now recovers quickly and that people’s purchasing power is maintained. To this end, the German government has initiated fiscal regulations designed to rapidly revitalise the economy and to support it in the longer term. They are part of the economic stimulus and future technologies package, which the coalition government elaborated and presented at the start of June.

The following are some of the main provisions:

1. Easing the burden for everyone

Stronger private consumption can help revitalise the domestic economy. To encourage more people to buy now rather than wait, value added tax rates have been cut from 19 to 16 per cent and from 7 to 5 per cent for a limited period. The reduced rates will apply from 1 July to 31 December 2020.

2. Assistance for families

Parents are to receive a one-off payment of 300 euros for each child for which they receive child benefit. This payment will be taxed but will not be deducted from social welfare benefits. It is designed to benefit low and middle income families in particular.

Single parents are to benefit from tax reductions. For 2020 and 2021 their annual tax-free allowance is to be increased from 1,908 euros to 4,008 euros.

3. Support for businesses

To ensure liquidity, businesses are to be better able to offset losses against profits in previous years. To this end, the tax losses in 2020 and 2021 that may be offset against profits in previous years will be raised to 5 million euros, or 10 million euros if the two years are taken together.

For 2020 and 2021 the opportunities for setting off business procurements against taxable income are to be enhanced. This is designed to motivate companies to invest now rather than postponing procurements.

In spite of the crisis, companies are to be able to invest in research and development, and thus in the future viability of their products. In line with this goal, the assessment basis for fiscal research promotion is to be doubled to an annual total of 4 million euros per company for a limited period until the end of 2025.