FAQs

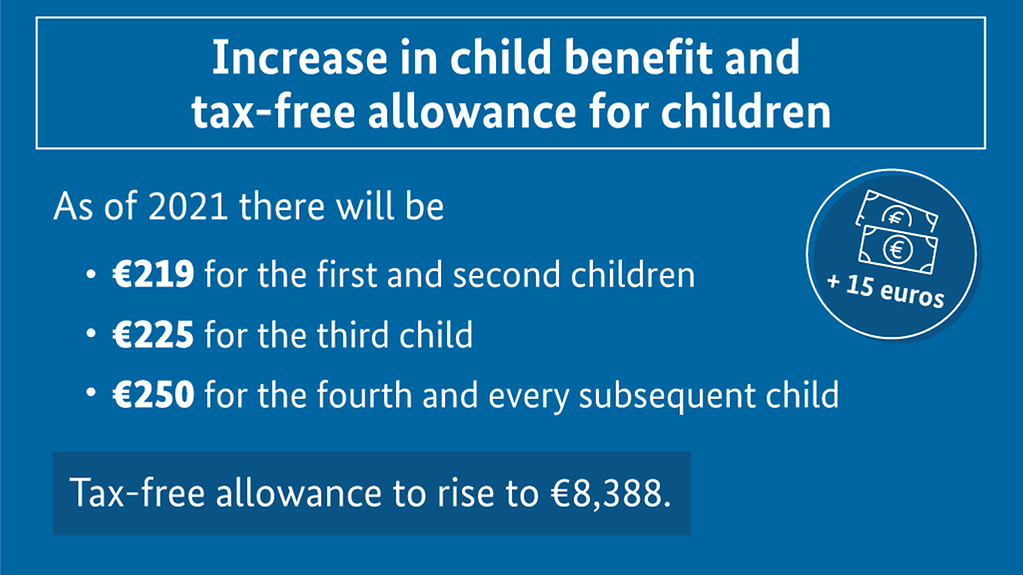

To support families and reduce the burden on tax-payers, the Cabinet has adopted the second Act to Reduce the Burden on Families (Familienentlastungsgesetz). As of 2021, child benefit will increase by 15 euros per child, while the tax-free allowance for children will be raised.

3 min reading time

The German government is to raise child benefit as of 1 January 2021 to ease the burden on families

Photo: Bundesregierung

The German government has earmarked 12 billion euros a year to reduce the burden on families and children. Families and low and middle earners in particular are to be supported by the second Act to Reduce the Burden on Families.

How much child benefit will parents receive in future?

Because of their family commitments, parents are often less able to improve their financial position than people who have no children. Child benefit is thus an important way of reducing the burden on families.

The second Act to Reduce the Burden on Families (Familienentlastungsgesetz) provides for an increase in child benefit of 15 euros per child, as of 1 January. Parents will thus receive 219 euros a month for the first and second child, 225 euros for the third child and 250 euros for the fourth child and any subsequent children.

What else is being done to reduce the burden?

When calculating income tax, the additional burden borne by families is also taken into account. This is why the German government is also raising the tax-free allowance for children and the tax-free allowance for childcare and education or training needs. Every tax-free allowance is to be raised by 144 euros for each parent, meaning that together parents will have an allowance of 8,388 euros a year that is exempt from income tax.

What do these changes mean for other tax-payers?

The basic tax-free allowance for adults is also set to rise. It will increase for both 2021 and 2022. By 2022, the sum that is exempt from income tax will rise to 9,984 euros per year, which is an increase of 576 euros over 2020. This change will benefit families and childless tax-payers alike.

| |||||||||||||||||||||||

What is special about the government’s initiative?

Under constitutional law, the basic tax-free allowance and the tax-free allowance for children must be brought into line with the provisions of the annual report on the minimum subsistence level. The coalition agreement, however, provides for tying the tax-free allowance for children to increases in child benefit. The tax-free allowance is thus higher than the minimum subsistence level for children. The government is making a sustainable move to reduce child poverty. As a result of moves to overcome "fiscal drag", the increase in the basic tax-free allowance for 2021 is also above the minimum subsistence level for adults.

In Germany income tax is based on levels of income. People receiving an increase in salary must also pay more tax. Rising prices can in fact mean that at the end of the day they have less money in their pocket than they did before receiving the raise. This phenomenon is known as "fiscal drag".