Pensions - an overview

In Germany, people can rely on the robust old age pensions system. Pensions have risen steadily in recent years, while contributions to the statutory pension scheme have remained stable. The German government will ensure that pensions remain sustainable, sound and dependable in future too. Here is an overview.

4 min reading time

Pensions should be fair and reliable for all generations.

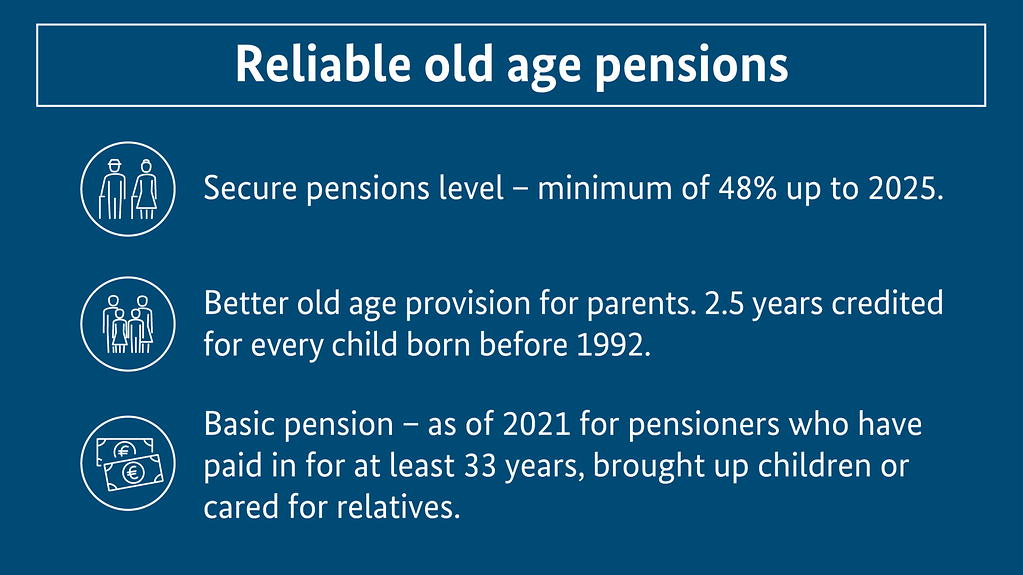

The diagram illustrating statutory pensions is entitled 'Reliable old age pensions' in white on a blue background.

Below this is a symbol of a man and a woman with walking sticks and beside it a text: Secure pensions level - minimum of 48% up to 2025.

Below this is a symbol of a couple with two children and the text: Better old age provision for parents. 2.5 years credited for every child born before 1992.

Below this is a symbol of banknotes and the text: Basic pension - as of 2021 for pensioners who have paid in for at least 33 years, brought up children or cared for relatives.

Photo: Bundesregierung

- The status quo – and the objectives of the German government for pensions

- This has been achieved to date ...

- And this is what we will do next for pensions ...

The status quo – and the objectives of the German government for pensions

In Germany, life expectancy is rising, while fewer and fewer children are being born. In future, the workforce who pay pension contributions will thus have to support an increasing number of pensioners. This demographic development is a huge challenge for the pensions system.

Pensions must be fair and reliable for all generations. That is the goal of the German government. In the German Bundestag, Federal Labour Minister Hubertus Heil declared, "Ensuring social cohesion through a reliable old age pension scheme is an investment in the future viability of Germany."

One major building block in a reliable old age pension system is, and will remain, the statutory pension insurance scheme. At the same time, the German government trusts in the three-pillar model: alongside statutory pensions, people should make provision for old age through company pensions, and private provisions.

This has been achieved to date ...

... with the help of the 2019 pensions package

The pensions package came into effect on 1 January 2019. In it the German government guarantees stable pensions levels until 2025 as well as stable pension contribution rates. It also enhances the position of mothers, people with reduced earning capacity, and low earners. Here is an overview of the individual provisions of the package:

- The level of pensions will remain stable at least 48% until 2025. This will benefit not only the 21 million current pensioners, but also future pensioners.

- The rate of pension contributions is currently 18.6%. It will not rise above 20% before 2025. This will ease the burden on the workforce who pay contributions into the pension scheme.

- Mothers and fathers, whose children were born before 1992 have been credited with two years of parental leave per child since 2014 (known colloquially as "Mütterrente I" or mothers’ pension I). Since January 2019, the "Mütterrente II" has credited them with another six months per child. Per child this translates as a total of two and a half points in the statutory pensions scheme.

- People with reduced earning capacity are deemed for pension purposes to have worked significantly longer than was actually the case. In 2019 the non-contributory supplementary period was raised to the equivalent of a retirement age of 65 years and 8 months. It is to be gradually raised to the age of 67 years.

- ‘Midi-jobber’ (with gross earnings of more than 450 euros a month and up to 1,300 euros a month) have since 1 July 2019 paid lower social insurance contributions with no adverse impact on their pension entitlements.

... thanks to the basic pension

As of 1 January 2021, pensioners who have paid into the statutory old age pension insurance scheme for a minimum of 33 years, brought up children or cared for family members, are to receive a tangibly higher old age pension in recognition of these services. The basic pension, a supplement to the statutory pension, is to enhance what have hitherto been low pensions. Find out more in our FAQs on the basic pension.

And this is what we will do next for pensions ...

... for all citizens

The digital pension overview is to make it easier to gain an overview of your individual old age pension status. In future, you will be able to easily check your entitlements from the statutory pension scheme, private provisions and company pension schemes online. The Cabinet agreed on a bill to this end on 26 August 2020.

...for the self-employed

The German government intends to introduce mandatory pension insurance for entrepreneurs. The goal is to prevent poverty in old age among this group. Basically, the self-employed are to be integrated into the statutory pension insurance scheme, although they will be exempted from it if they can provide evidence that they have made adequate alternative provisions.

In view of the difficult economic circumstances for the self-employed in particular resulting from the COVID-19 pandemic, the government is currently considering how the mandatory old age pension insurance for the self-employed can be made part of an overall concept to assist this group. Although the current situation demonstrates how important it is to have a secure and reliable pension scheme for the self-employed, it must also be ensured that it is accepted by the target group.