Budget debate

Against the background of the ongoing refugee situation, Federal Finance Minister Wolfgang Schäuble is allowing for several billion euros more in the national budget, but he is sticking to the government’s plans for no new borrowing.

5 min reading time

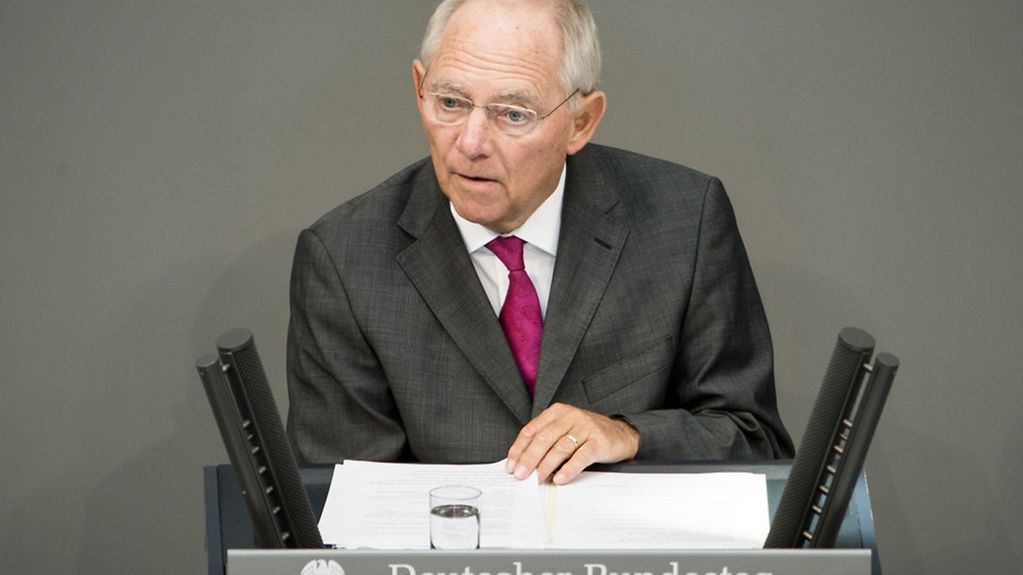

Finances must be brought into line with the refugee situation and not vice versa, says Wolfgang Schäuble

Photo: picture alliance / dpa

"This is a test for Germany. We can manage it together – without running up any new debt," said Wolfgang Schäuble in the German Bundestag.

Wolfgang Schäuble explained that economic development in Germany, and the country’s sound financial position give it the leeway it needs to master the challenges currently facing it. In the coming year, the federal government can spend 312 billion euros – 10.4 billion more than the German Bundestag approved as spending for the ongoing budget year. There is to be no net borrowing in 2016, as is already the case this year. This is spelled out in the government draft of the 2016 budget and the financial plan for the period up to 2019, which Federal Finance Minister Wolfgang Schäuble has now laid before the German Bundestag.

Refugee situation – an opportunity and a challenge

Wolfgang Schäuble sees challenges in the following areas:

- Accommodation for refugees: Initial reception centres are to be expanded. 150,000 new winter-proof accommodation places are to be created.

- Speeding up the processing of requests for asylum: To speed up processing, another 2,000 jobs are to be created at the Federal Office for Migration and Refugees (BAMF).

- Integrating refugees: Refugees who have good prospects of remaining in Germany should be enrolled as swiftly as possible in German language and integration courses and should be allowed to work. The BAMF’s budget for integration courses will be topped up to make this possible.

- Support through volunteers: 10,000 new jobs are to be created under the auspices of the German government’s voluntary service scheme.

German government to support federal states and local authorities

The German government is doing its duty by providing an additional six billion euros for the coming year, some of which will go to the federal states and local authorities, explained Wolfgang Schäuble. "Germany can cope with the financial burden, because the country is currently in a state of robust economic health and domestic demand is holding up, in spite of the risks that can be seen at the level of the global economy," he declared. Germany’s sound budget management in particular has given the country the financial leeway it needs, he added.

Cooperation will be needed at every level of government. Financing will have to be brought into line with the refugee situation and not vice versa, said the Federal Finance Minister. He said that the situation must be viewed as an opportunity rather than merely a cost factor. Any other attitude would potentially jeopardise the public acceptance of the refugees.

Single largest departmental budget - labour and social affairs

From 8 to 11 September the German Bundestag will be deliberating the draft budgets for the individual federal ministries. The ministry with the largest budget will remain the Federal Ministry of Labour and Social Affairs. According to Wolfgang Schäuble, half of government spending in 2016 will be accounted for by social benefits and services, as a result of pension payments, which will remain high at an expected 86.6 billion euros in 2016.

Andrea Nahles, Federal Minister of Labour and Social Affairs will have some 127.9 billion euros to spend next year, according to the plans of the government. This is 1.63 billion euros up on the 2015 figure.

Strengthening investment in the future

The German government is not only consolidating the budget. It will also continue to strengthen other important political priorities and step up investment in specific areas. The spending of the Federal Ministry of Education and Research (BMBF) is to rise by around 1 billion euros to some 16 billion euros. The BMBF has seen its budget rise by 60 per cent since 2007. Spending on traffic and transport is to rise by about 1.12 billion euros to 24.4 billion euros.

Rise in spending up to 2019

According to the government’s financial plan, the spending of the federal government is to rise to 333.1 billion euros by 2019. The government expects that by the end of 2019 the national debt will drop to 61.5 per cent of the country’s gross domestic product (GDP). It aims to push the debt rate below the 70 per cent mark in 2016, which will bring it closer to the reference value of 60 per cent laid out in the Maastricht Treaty. There is to be no new borrowing in any year covered by this latest financial plan.

The government expects the overall economic upswing to continue for the rest of this year. The spring forecast put economic growth this year and next year at 1.8 per cent of GDP.

The 1992 Maastricht Treaty lays down criteria to be met be countries before they join the currency union. These are known as the convergence criteria or "Maastricht criteria". They include a high degree of price stability, stable long-term interest rates, stable exchange rates and an upper limit on public deficits and government debt for EU member states.

The people benefit from sound development

This year and next year the German economy is expected to continue to do well, reported Wolfgang Schäuble. Germany has chalked up a new record, with 43 million people in work. Last year real wages rose by 1.7 per cent. "The people in Germany benefit from this," stressed Wolfgang Schäuble.

Several different factors will put over five billion euros more in the pockets of the German people every year: moves to tackle what is termed "cold progression" (a phenomenon which can occur when wage rises do no more than offset inflation, but the increased income pushes the earner into a higher tax bracket thus effectively reducing available income), the raising of the basic tax-free allowance and the tax-free allowance for dependent children, as well as increased child benefit and child supplement payments.