Budget debate

Easing the burden on families, encouraging the construction of housing, forging ahead with digitalisation – these are the focuses of the 2019 budget and the financial plan for the period up to 2022, which Federal Finance Minister Olaf Scholz has now presented to the German Bundestag.

3 min reading time

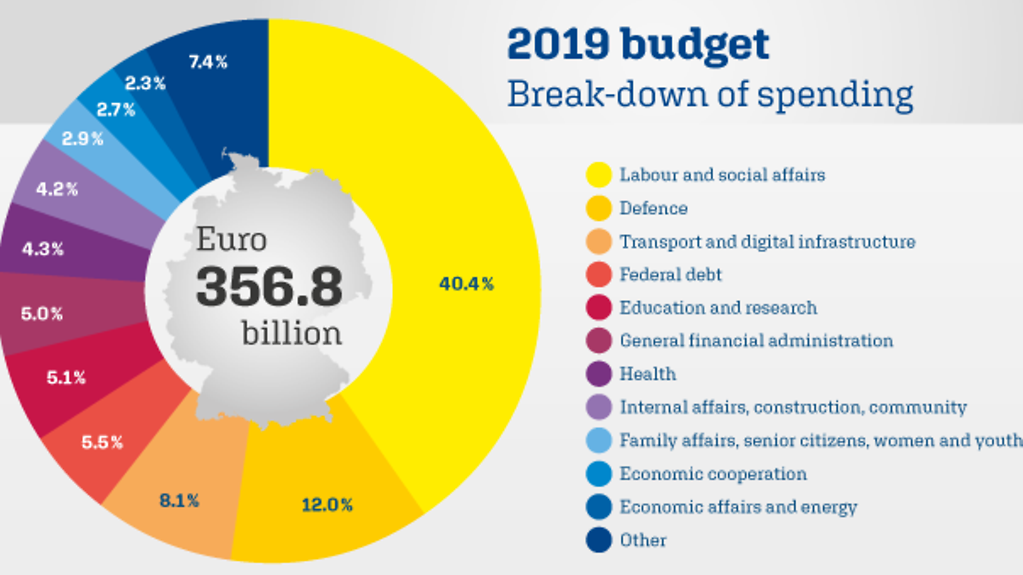

The 2019 budget is worth a total of EUR 356.8 billion

Photo: Bundesregierung

This will be the fifth consecutive budget with no new borrowing.

"We want our country to move forward," stressed Federal Finance Minister Olaf Scholz, speaking in the German Bundestag. This budget will help people to look forward to the future with confidence. The German government is making provision for this.

At the same time, it is important to stick to the principles that allowed Germany to come through the financial crisis in good shape. The German government will thus continue its sound budgetary policy. The 2019 budget will be the fifth in a row with no new borrowing.

The 2019 budget embraces spending worth a total of 356.8 billion euros, 13.2 billion euros more than 2018. In 2019 Germany will again be below the Maastricht debt limit of 60% of gross domestic product (GDP) for the first time since 2002.

Strengthening cohesion in Germany

The German government aims to strengthen social cohesion amongst the population. Germany must not allow itself to be divided, warned Olaf Scholz. His budget, he said, is designed to help improve people’s living conditions and underpin their prosperity. The German government has already launched a number of measures. He pointed to the Act to Reduce the Tax Burden of Families (Familienentlastungsgesetz), the cut in unemployment insurance contributions, and improvements in disability pensions and pensions for mothers.

More funds have been planned for additional projects: to improve childcare in nurseries and schools, for social housing construction and tenant protection, and for training or upgrading the long-term unemployed.

Reducing the tax burden of families and low-earners

Families and low-earners will see a tangible reduction to their tax burden – thanks to an increase in the basic tax-free allowance, the increase in child benefit and the rise in the tax-free allowance for children, as well as a reduction in fiscal drag in tax law. The child supplement will also be increased.

Finally, the solidarity surcharge will be gradually abolished as of 2021 for 90 per cent of all tax-payers.

Investing in an effective state

In the coming year, investment spending will focus on digitalisation. The German government has undertaken to step up the development of the country’s digital infrastructure, as well as promoting research and digital education.

Security and law and order will also remain important topics. The German government will make significant funding available to fit out the federal police force, the customs authorities and the Federal Office for Migration and Refugees with appropriate staffing levels.

Strengthening European cooperation

The budget also provides for additional spending in the fields of defence and development cooperation. Olaf Scholz advocated stronger European cooperation in this context. "We need common military procurement because we will otherwise never be able to ensure the level of security we need in Europe," he said.

It is also important, he continued, to stabilise the European Union in economic terms and to equip it for any future crises. Projects like the completion of the banking union should thus be resolutely moved forward.

What happens next with the budget

1st reading in the German Bundestag: 10 to 14 September

1st reading in the second chamber or Bundesrat: 21 September

2nd/3rd reading in the German Bundestag: 23 November

2nd reading in the Bundesrat: 14 December